115-97 moved the United States from a worldwide system of taxation towards a territorial system of taxation. Relief for those impacted outside the disaster areas.

Personal Tax Reliefs 2020 Malaysia

2017-4-6This is either under an applicable tax treaty or UK unilateral relief.

. 2022-10-20Dato Sri Hajji Mohammad Najib bin Tun Haji Abdul Razak Jawi. Born 23 July 1953 is a Malaysian politician who served as the sixth prime minister of Malaysia from April 2009 to May 2018. 2020-12-8Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

2022-10-19The IRS is making this relief available to any area designated by the Federal Emergency Management Agency FEMA. Conditional waiver of surcharges for instalment settlement of demand notes for the Year of Assessment 201819 Individuals. 2022-10-19Get the latest international news and world events from Asia Europe the Middle East and more.

2022-9-14With tax playing an important role in the response to the coronavirus COVID-19 pandemic the OECD has compiled the tax policy measures taken by governments to support households and businesses with the economic challenges of the crisis. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. In some circumstances the taxpayer can elect for the foreign tax to be deducted from the taxable amount in the United Kingdom as an alternative to having a credit for the foreign tax suffered.

In 2020 he was convicted of corruption in the 1Malaysia Development Berhad scandal one of the largest. Country tax measures during the COVID-19 pandemic database Xlsm updated 22 April 2021. May not be combined with other offers.

Worldwide average retail price per 750ml ex tax USD from Nov 2020 to Oct 2022. Find the latest reporting on US. Senate race border wall gets a makeover.

ASCII characters only characters found on a standard US keyboard. 2 days agoTax Exemptions in respect of Relief Measures under the Anti-epidemic Fund Relief Measure. Tax relief period in terms of years.

Among other things PL. Must contain at least 4 different symbols. 2 days agoGiven below are the income tax rates for FY 2021-22 AY 2022-23 and FY 2022-23 under the old tax regime.

Under the old income tax regime a higher tax exemption limit is available to senior citizens and super senior citizens. Recent articles reported by our team on important business-news developments. Chapter 18 also deals with the tax relief provided to the companies in lieu of the charitable work that they.

A resident company in operation for not less than 36 months that incurs capital expenditure to expand modernise automate or diversify its existing manufacturing business or approved agricultural project is. The big and beautiful US-Mexico border wall that became a key campaign issue for Donald Trump is getting a makeover thanks to the Biden administration but a critic of the current president says dirty politics is behind the decision. Hong Kong has activated exchange relationships under AEOI with other jurisdictions on the basis of bilateral competent authority agreements or a multilateral competent authority agreement under the Convention on Mutual Administrative.

The rules relating to non-doms changed from 6 April 2017. 2022-10-17Get the latest science news and technology news read tech reviews and more at ABC News. The FEMA declarations permit the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in disaster areas.

2022-8-1US tax reform legislation enacted on 22 December 2017 PL. Spring was cooler than normal even blowing cold for a couple of weeks in Alexander Valley. 2022-10-20Exempt until 31st march 2018Capital gains more than Rs1 Lakh are taxable at 10 15.

2020-6-5This is in line with findings from the World Bank SME Support Measures dashboard which suggests that out of 845 SME policy instruments used worldwide 328 relate to debt finance loans and guarantees 205 to employment support and 151 to tax. Segala maklumat sedia ada adalah untuk rujukan sahaja. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations and FFI agreement if applicable or comply with the. Alan Lovell says households consume too much water and metering is needed to encourage them to cut. An individual is considered a Senior Citizen if an individual crosses the age of 60 years during the financial year.

2018 Dominus Estate Christian. Our national magazine with long and short form articles on critical leadership issues. محمد نجيب بن عبدالرزاق Malay pronunciation.

6 to 30 characters long. 2022-8-2Politics-Govt Just in time for US. Special incentive schemes Reinvestment allowance.

2022-8-15This Week In Leadership. Offer period March 1 25 2018 at participating offices only. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

2015-8-18FATCA requires foreign financial institutions FFIs to report to the IRS information about financial accounts held by US. How to find a mattress you can happily sleep on for years. Taxpayers or by foreign entities in which US.

67 Structural policies have been used only modestly with a focus on teleworking and digitalisation. 115-97 permanently reduced the 35 CIT rate on resident corporations to a flat 21 rate for tax years beginning after 31 December 2017. Taxpayers hold a substantial ownership interest.

2018-5-18After the wildfires of 2017 the calm growing season of 2018 was a welcome relief. The first information period refers to the first period the information of which has to be reported to the Department. 2022-10-18Water meters should be compulsory and bills should rise says new Environment Agency chairman.

To qualify tax return must be paid for and filed during this period. This chapter deals with the income tax relief given to the companies for the dividends they pay to their shareholders.

Healthcare Financing And Social Protection Policies For Migrant Workers In Malaysia Plos One

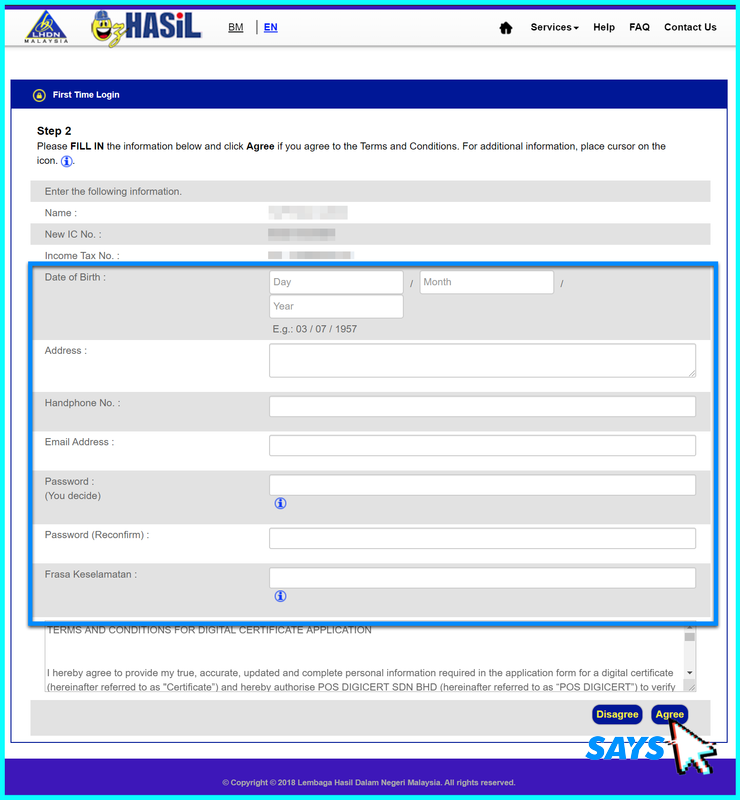

How To File Income Tax For The First Time

Tax Rebate And 3 Other Benefits Of Life Insurance

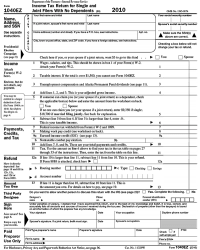

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

The Impact Of The Covid 19 Pandemic And Policy Response On Single Parent Families In Malaysia Emerald Insight

Covid19 The Impact On Thailand S People And Economy

Corporate Tax Rates Around The World Tax Foundation

Pemerkasa Assistance Package Crowe Malaysia Plt

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Shinee 21ct On Twitter Plz Read Amp Rt Shinee We Would Like To Inform Mini Fundraising Project For Shinee10thanniversary Was Successfully Organized Amp All Funds Was Donated To Irmalaysia On Behalf Of Shinee

What Are The Sources Of Revenue For Local Governments Tax Policy Center

Everything You Should Claim As Income Tax Relief Malaysia 2020 Ya 2019

Consumer Spending Forecast 2021 Deloitte Insights

Things You Might Not Know About Personal Tax Finposts Com

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical Insurance Read This Ibanding Making Better Decisions